The Indian sky is about to get a lot more busy. In a strategic move designed to strengthen national infrastructure rather than just challenge existing giants, the Indian government has officially greenlit three new airlines: Shankh Air, Alhind Air, and FlyExpress.

Civil Aviation Minister Ram Mohan Naidu confirmed this week that all three carriers have received their No Objection Certificates (NOCs). While Shankh Air secured its approval in September 2024, Alhind Air and FlyExpress were cleared on December 23, 2025. This regulatory "green light" allows these companies to begin the complex process of hiring crews, leasing planes, and preparing for takeoff in early 2026.

A Tactical Shift: Strengthening the Regional Safety Net

These new airlines are not aimed at "toppling" giants like IndiGo or Air India, the move is actually a tactical effort by the government to expand the UDAN scheme (Ude Desh ka Aam Naagrik).

UDAN: Strengthening India’s Regional Aviation

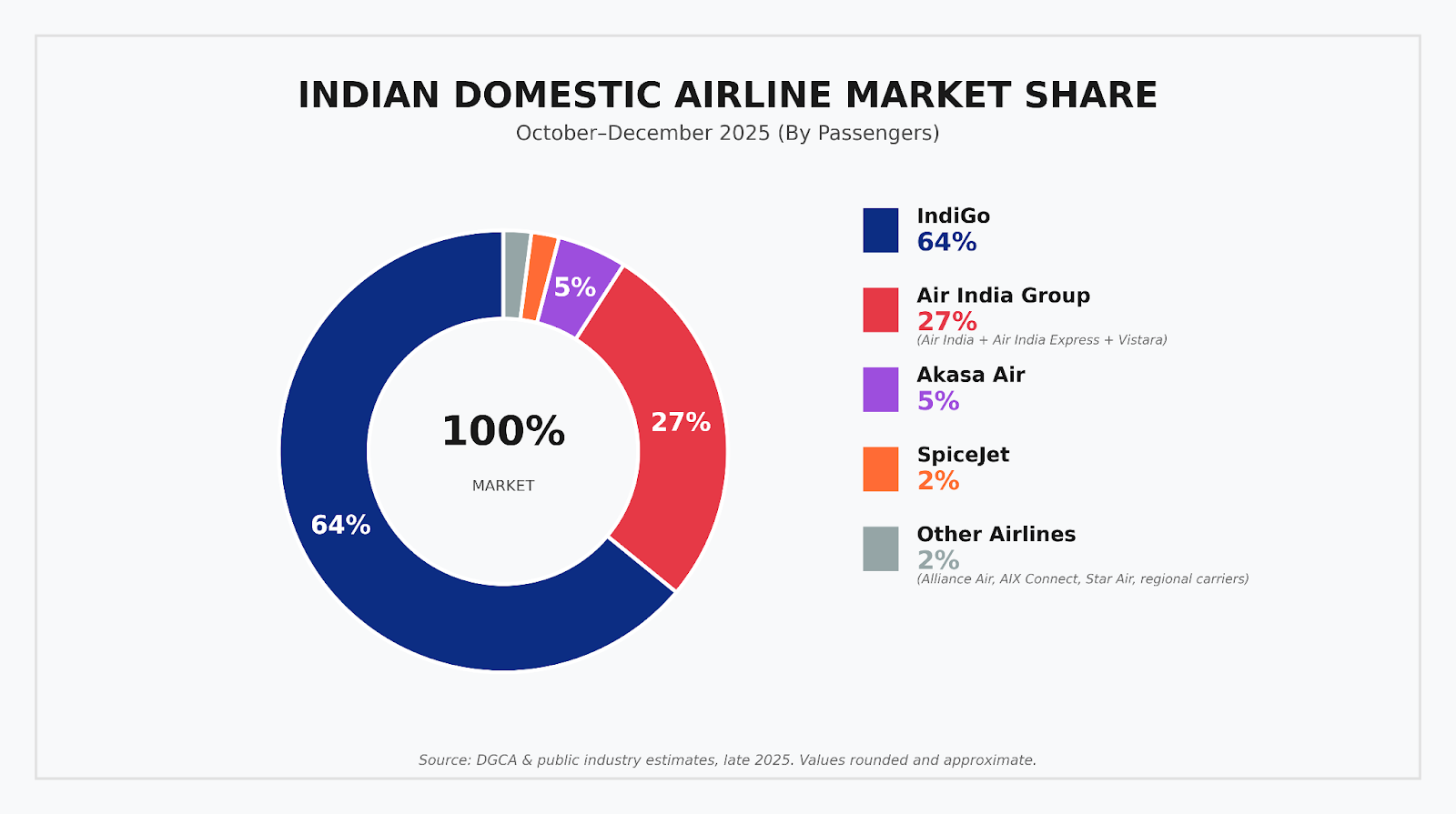

UDAN is a regional connectivity program that uses government subsidies to make flying affordable for the common citizen in smaller cities. Currently, India’s aviation market is dominated by a "duopoly" where IndiGo and Air India control over 90% of traffic, mostly between major hubs like Delhi and Mumbai. By encouraging these three new players, the government is focusing on "Tier-2" and "Tier-3" cities—places like Varanasi, Gorakhpur, and Kochi—where large jets are mostly too big to fly profitably.

Why Now? The "IndiGo Crisis" as a Turning Point?

The urgency behind these approvals increased following a massive operational collapse at IndiGo in early December 2025.

What began as a struggle to adapt to new, stricter pilot rest rules (Flight Duty Time Limitation or FDTL) spiraled into a week of chaos. Between December 2 and December 8, IndiGo was forced to cancel over 4,500 flights, leaving thousands of passengers stranded. Because IndiGo controls such a massive share of the market, there were no "buffer" airlines to pick up the slack, turning a staffing issue into a national infrastructure crisis.

The crisis proved that over-reliance on a single player makes the entire country’s travel network fragile. These three new entrants might represent the "Plan B" that India desperately needs.

India’s airline sector remains competitive, with several carriers operating sizable fleets across domestic and international routes.

The New Wings of Indian Aviation: Meet the 2026 Entrants

1. Shankh Air

The Full-Service Regional Specialist

Shankh Air is the most advanced in the regulatory process and positions itself as a premium, full-service alternative in a market dominated by low-cost carriers.

| Category | Details |

|---|---|

| Official Website | www.shankhair.com |

| Founder & Promoter | Shravan Kumar Vishwakarma, a Kanpur-based entrepreneur who rose from humble beginnings (once a tempo driver) to lead Shankh Agencies Pvt. Ltd., a diversified group in construction, ceramics, and logistics. |

| Operational Hubs | Lucknow and Noida International Airport (Jewar). |

| Launch Timeline | Expected to commence operations in Q1 2026, coinciding with the opening of the Noida International Airport. |

| Business Model | Full-Service Carrier (FSC) focused on passenger comfort and "affordable premium" experiences. |

| Fleet Strategy | Deploying Next-Generation Boeing 737-800 aircraft. |

| Fleet Target | Targeting a fleet of 20–25 aircraft within the first 3 years. |

| Route Focus | Intra-State: Connecting Lucknow to Varanasi, Agra, and Gorakhpur. Inter-State: Linking Uttar Pradesh to major metros like Delhi, Mumbai, and Bengaluru. |

| Philosophy | Based on "Vasudhaiva Kutumbakam" (The world is one family). |

2. Alhind Air

The South India-Gulf Bridge

Backed by one of India’s largest travel conglomerates, Alhind Air enters the market with a massive pre-existing customer base and a strong focus on the expatriate market.

| Category | Details |

|---|---|

| Official Website | www.alhindair.com |

| Founder & Promoter | Mohammed Haris, Chairman of the Alhind Group. The group is a ₹20,000 crore turnover conglomerate with 30+ years of experience in travel and tourism. |

| Operational Hub | Kochi (Cochin International Airport - CIAL). |

| Launch Timeline | Set to debut in early 2026. |

| Business Model | Regional commuter airline with a rapid transition plan to international services. |

| Fleet Strategy | Phase 1: Launching with ATR 72-600 turboprop aircraft for domestic hops. Phase 2: Inducting Airbus A320 aircraft for international expansion. |

| Goal | 7 aircraft in the first year; 40 Indian cities in the long term. |

| Route Focus | Domestic: Southern India (Kochi, Bengaluru, Thiruvananthapuram, Chennai). International: High-demand routes to the Gulf region (UAE, Saudi Arabia, Qatar, Oman, Kuwait). |

3. FlyExpress

The Regional Logistics Expert

FlyExpress is the "lean" entrant of the trio, focusing on underserved regional routes and leveraging its background in cargo and courier services.

| Category | Details |

|---|---|

| Official Website | www.flyexpress.in |

| Promoter | Led by Konakati Suresh, a Hyderabad-based entrepreneur with deep roots in international logistics and cargo services. |

| Operational Hub | Begumpet, Hyderabad. |

| Launch Timeline | Received NOC in late December 2025; currently securing its Air Operator Certificate (AOC) for a 2026 launch. |

| Business Model | Regional carrier focused on Tier-2 and Tier-3 connectivity and cargo-integrated passenger services. |

| Operational Strategy | Heavy reliance on the government’s UDAN scheme to connect underserved regions. |

| Core Strength | Extensive experience in international logistics (medicines, industrial goods) will support a dual-revenue model of passenger and belly cargo operations. |

The Reality Check: Can They Survive?

While the government's support is strong, the path from an NOC to actual flights is a "Growth Paradox." India’s aviation history is a graveyard of regional dreams, from Jet Airways to Go First and most recently FlyBig (suspended in Oct 2025).

The three new entrants might face significant hurdles:

-

Sky-High Fuel Costs: Aviation Turbine Fuel (ATF) makes up nearly 40% of an airline’s expenses. In India, ATF is not under the GST (Goods and Services Tax), meaning airlines pay high and varied state taxes, making fuel in India among the costliest in the world.

-

The Plane Shortage: There is a global backlog of new aircraft. Getting Boeing or Airbus to deliver planes on time is currently one of the hardest tasks in the industry, forcing new airlines into expensive "wet leases" (renting planes with crews).

-

Airport "Slots": Busy airports like Delhi and Mumbai have almost no room left for new flights during peak hours. New airlines often have to fly at "odd hours," which can reduce passenger demand.

Expert Insight:

"The Indian aviation sector is currently a graveyard of regional dreams—from Jet Airways to Go First and most recently FlyBig (suspended Oct 2025). For the 2026 entrants to survive, they must move beyond 'flying for the sake of flying' and focus on niche route profitability and deep capital reserves."

— Kapil Kaul, CEO of CAPA (Centre for Aviation) India.

Looking Ahead: A More Resilient Sky

The entry of these three airlines underscores India’s ambition to build a more resilient and competitive aviation ecosystem. For passengers, the promise lies in greater choice and improved connectivity to hometowns. For the global aviation industry, it signals that India remains a market of long-term strategic importance.

As these airlines move toward securing their Air Operator Certificate (AOC) for a 2026 launch, they will be the primary case study for market resilience in a country that aims to become the world's aviation capital by 2047.